early friday morning...

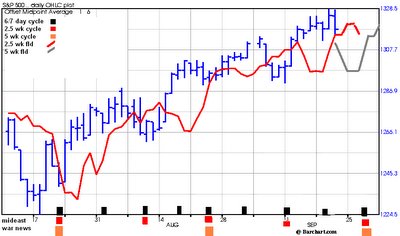

early friday morning...the markets may have put in a top for the nominal 5 wk cycle, due to bottom next week. since there was some negative fed news associated with thursday's decline it is still possible for SPX to rally or attempt to make a higher high in the next day or two before the low of that cycle is due. this chart shows the likely window for the next 5 wk cycle bottom. if the 2.5 wk fld line (red) is crossed to the downside tomorrow (determined by a line connecting thursday's midpoint price to friday's midpoint price) we will get a downside projection, indicating the decline into the 5 wk low is confirmed.

click on chart for detail...

0 Comments:

Post a Comment

<< Home