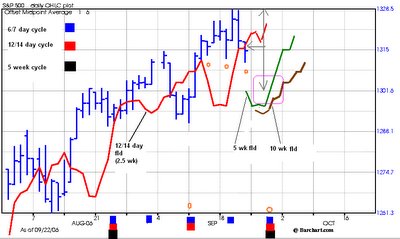

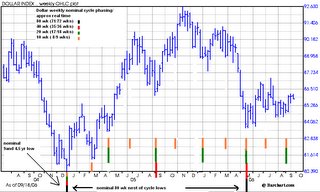

cycle projections

SPX fld projection chart....a few days after the SPX june low around 1220 i posted a forecast on a few message boards based on expected future fld crossings that SPX would test it's may highs and most likely move toward a new high near 1370 +/- some points. i estimated it should occur by late aug/sept. in july i revamped my commonality phasing model resulting in a re labeling of the 20 wk cycle low and thus extending the time window for these events to take place. the revamping did not have an effect on fld status since they are based on actual sample lengths of the nominal cycles in hurst's model.this chart shows the subsequent fld crosses and targets. SPX got to within 15 pts of the lower window for the 40 wk cycle projection today. we do have an upcoming nest of cycle lows due at the end of oct/early nov so some caution is warranted. trendline breaks, downside crosses of smaller cycle flds (not shown), should be watched.

click on chart for detail.........