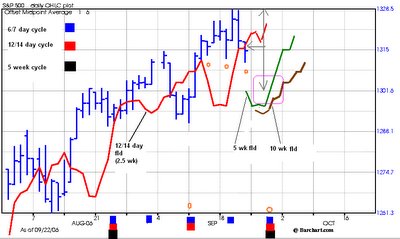

upcoming 5 wk cycle bottom

the current short term cyclic picture for SPX. we're due for a nominal 5 wk nest of cycle lows bottom ideally this wed/thur. the only price projection into that low comes from the nominal 2.5 wk (12/14 day) cycle fld. the grey arrows point to the fld break and the measured move from top to bottom. fld targets are undershot, met, or overshot based on the prevailing trend. the highlighted in purple area is a key to watch next week. the price level SPX reaches at the expected 5 wk low will IMO be a clue to whether SPX can attempt to reach the projected 1370 area +/- approx 15 pts. a test of the highs (achieved), followed by a move to the 1370 area, was made using these same fld methods after the june SPX low. the higher this next 5 wk bottom the higher the chances to meet that target before the next important nest of cycle lows due the end of oct/early nov. other features on the chart show that the 5 wk cycle fld did not give a downside target due to trend and right translation of the cycles. that usually implies strength. it may or not be tagged or crossed this week.marked with little orange 0's are the nominal 3/3.5 day cycles. these are usually easier to locate on intraday charts, notice how the last two 3 day bottoms have made lower lows, indicating the 12/14 day and 5 wk cycle topping and rolling over process. there may or may not be one more very short term pop up off this last 3 day cycle before the 5 wk low is due.

click on chart for detail....

0 Comments:

Post a Comment

<< Home